August 11, 2024

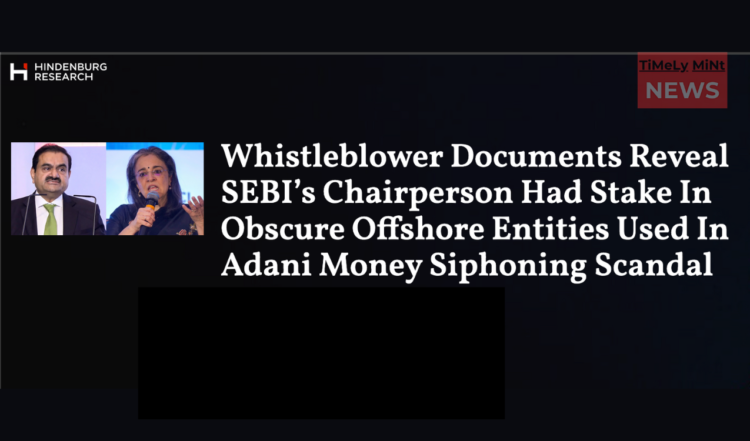

In a detailed and explosive report, Hindenburg Research has alleged that Madhabi Buch, the current Chairperson of the Securities and Exchange Board of India (SEBI), was involved in offshore financial networks that were purportedly used by the Adani Group for extensive money laundering activities. The allegations have cast a shadow over SEBI’s ongoing investigation into the Adani conglomerate and raised serious concerns about potential conflicts of interest within the regulatory body.

The Adani Group and Hindenburg’s Initial Findings

The Adani Group, one of India’s most influential and diversified business conglomerates, has been under intense scrutiny since January 2023, when Hindenburg Research published a landmark report accusing the company of orchestrating “the largest con in corporate history.” According to Hindenburg, the Adani Group utilized a complex web of offshore entities, primarily based in Mauritius, to engage in undisclosed related-party transactions, stock manipulation, and other financial malfeasance.

Hindenburg’s report laid out what it described as overwhelming evidence, including detailed documentation of billions of dollars funneled through these offshore entities to manipulate stock prices and conceal the true financial condition of the Adani Group. Despite the serious nature of these allegations and subsequent investigations by over 40 independent media outlets, SEBI, the regulatory authority responsible for overseeing India’s securities markets, has not taken any significant public action against the Adani Group.

SEBI’s Alleged Inaction and the Emerging Conflict of Interest

In June 2024, SEBI issued a ‘show cause’ notice to Hindenburg Research, which focused on technicalities related to the disclosure of Hindenburg’s short position on Adani stocks. The notice did not challenge the substantive findings of Hindenburg’s 106-page report but instead criticized the sufficiency of the disclosures surrounding their short position. This move was seen by many observers as a deflection from the core issues raised by Hindenburg’s investigation, further fueling concerns about SEBI’s impartiality.

The situation took a dramatic turn when Hindenburg Research, in a follow-up report, revealed that Madhabi Buch and her husband, Dhaval Buch, held investments in offshore funds allegedly connected to the very financial networks they were tasked with regulating. According to whistleblower documents cited by Hindenburg, the Buchs opened an account with the IPE Plus Fund 1 on June 5, 2015. This fund, registered in Mauritius, is part of a multi-layered offshore structure that Hindenburg claims was used by Vinod Adani, the brother of Gautam Adani, to siphon money from India through over-invoicing of power equipment imports.

Hindenburg’s report further alleges that just weeks before Madhabi Buch’s appointment as a Whole Time Member of SEBI in April 2017, her husband took steps to consolidate control over these offshore accounts. The timing of these actions, according to Hindenburg, suggests an effort to shield their financial activities from public scrutiny as Madhabi Buch assumed a significant regulatory role.

The Offshore Entities and Their Alleged Role in the Adani Scandal

The IPE Plus Fund 1, where the Buchs allegedly held their investments, is described by Hindenburg as being nested within a complex offshore structure that also includes the Global Dynamic Opportunities Fund (GDOF) in Bermuda, a notorious tax haven. According to Hindenburg, the GDOF was used to funnel money back into the Indian stock market, potentially inflating the value of Adani Group shares and maintaining the illusion of financial stability within the conglomerate.

Hindenburg’s report underscores the troubling implications of Madhabi Buch’s alleged involvement in these offshore funds, particularly given her role as SEBI Chairperson. The report suggests that her position afforded her significant influence over the regulatory process, raising concerns about whether SEBI’s investigation into the Adani Group was compromised by conflicts of interest.

Criticism from the Indian Supreme Court

The Indian Supreme Court has previously criticized SEBI’s investigation into the Adani Group, noting that the regulator had “drawn a blank” in its efforts to uncover the true owners of the offshore entities involved. Hindenburg’s latest report suggests that SEBI’s lack of progress may be linked to the Chairperson’s alleged involvement in similar offshore structures, which could have influenced the regulator’s willingness to pursue the case aggressively.

Hindenburg’s report implies that SEBI’s apparent reluctance to take meaningful action against the Adani Group could be rooted in these potential conflicts of interest. The report raises the question of whether SEBI, under Madhabi Buch’s leadership, can be trusted to act as an impartial regulator in this high-profile case.

Additional Allegations: The Blackstone Connection

In addition to the allegations concerning the Adani Group, Hindenburg Research also highlights a significant potential conflict of interest involving Madhabi Buch’s husband, Dhaval Buch. According to the report, Dhaval Buch was appointed as a Senior Advisor to Blackstone, a major global private equity firm, in July 2019. This appointment is particularly noteworthy because Blackstone has been a prominent player in India’s Real Estate Investment Trusts (REITs) market, an asset class that SEBI has actively promoted under Madhabi Buch’s leadership.

Hindenburg notes that since Madhabi Buch became SEBI Chairperson in March 2022, the regulator has introduced several regulatory changes that have significantly benefited private equity firms like Blackstone. These changes include new frameworks for REITs and other related investment vehicles, which have facilitated the growth of this asset class in India.

Despite her position as SEBI Chairperson, Madhabi Buch has been a vocal advocate for REITs, frequently promoting them at industry conferences. Hindenburg’s report points out that she has described REITs as her “favorite products for the future,” while failing to disclose her husband’s ties to Blackstone—a firm that stands to gain from the regulatory changes she has championed.

Hindenburg’s Conclusion: A Call for Transparency and Accountability

Hindenburg Research concludes its report by calling for greater transparency and accountability within SEBI. The allegations against Madhabi Buch, if proven true, suggest a severe conflict of interest that could undermine the integrity of SEBI’s investigation into the Adani Group and its ability to regulate the broader financial market.

The report emphasizes the need for an independent inquiry into these allegations to restore public confidence in SEBI and to ensure that the regulatory process is free from bias and undue influence. Hindenburg’s findings raise significant questions about the effectiveness of financial regulation in India and the potential for regulatory capture by powerful business interests.

As the situation continues to unfold, Hindenburg Research has stated that it will continue to monitor developments closely and provide further updates as new information becomes available.