In the intricate dance of democracy and governance, the role of political funding takes centre stage, moulding the landscape of political discourse and action. The introduction of the Electoral Bond Scheme by the Indian government in 2018 signalled a significant step towards bolstering transparency and accountability in political donations. Crafted to safeguard donor identities while ensuring a clean flow of funds into the political arena, the scheme had ignited widespread debate about the motivations driving anonymous contributions to political parties. This article delves into the multifaceted motivations behind these political donations, illuminating the complexities of anonymous political funding in a democratic setup.

The Electoral Bond Scheme: Bridging Transparency and Anonymity

The Electoral Bond Scheme was introduced by the Government of India in January 2018 through a gazette notification by the Ministry of Finance. The scheme aimed to cleanse the system of political funding in India and bring greater transparency while protecting donor anonymity. I know it sounds Oxymoronic but this was the intention as claimed by the Government.

Background and Objectives

India has struggled with the challenge of opaque and unaccounted political donations for decades. Historically, political parties have relied on cash donations, which often come from undisclosed sources and can be used for illicit purposes. To address this issue and bring more transparency to political funding, the government introduced the Electoral Bond Scheme.

The key objectives of the Electoral Bond Scheme were:

- Cleansing Political Funding: By channeling donations through the formal banking system, the scheme aimed to reduce the influx of black money and untraceable cash into political financing.

- Protecting Donor Identity: The scheme allowed donors to purchase bonds without disclosing their identity, thus providing anonymity and reducing the fear of repercussions for supporting a particular political party.

- Encouraging Wider Participation: By providing a secure and anonymous means of donating, the scheme seeks to encourage a wider range of individuals and organizations to contribute to political parties, thus broadening participation in the democratic process.

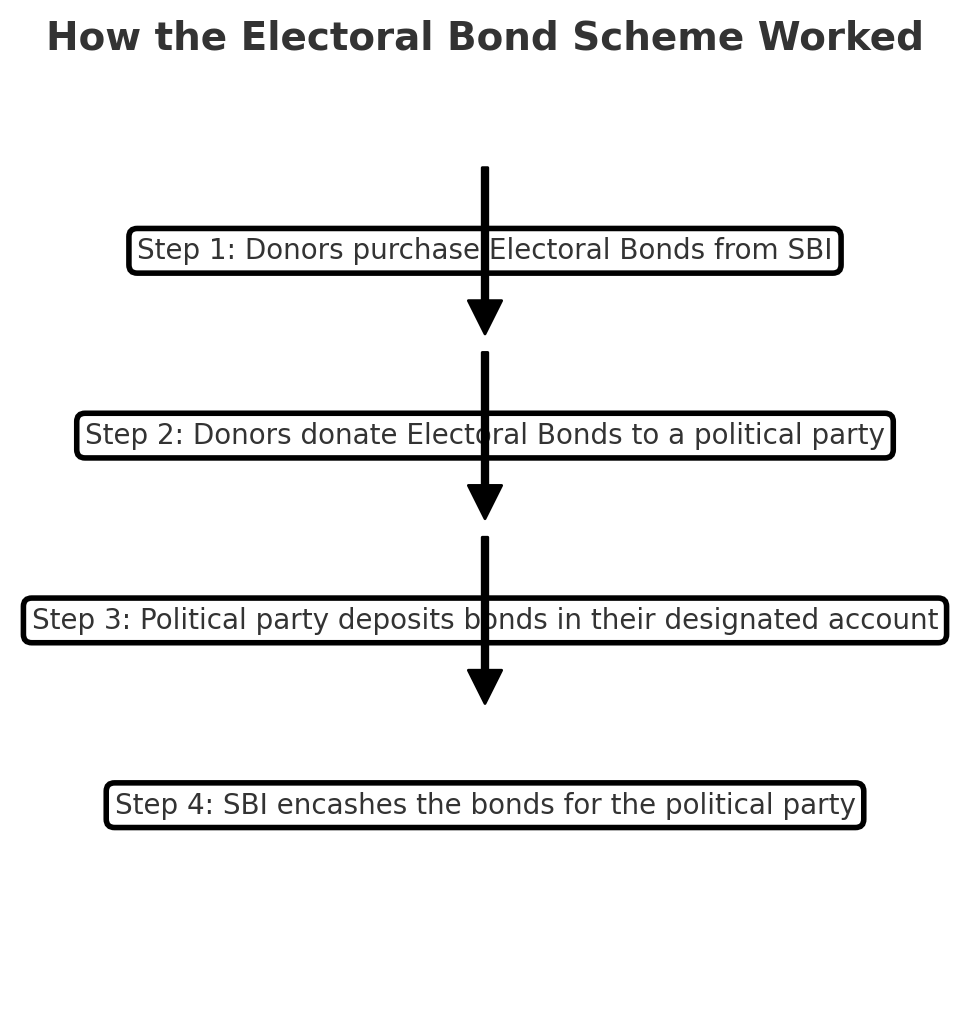

How the Scheme Worked

Under the Electoral Bond Scheme, donors could purchase bonds from designated branches of the State Bank of India (SBI) in multiples of ₹1,000, ₹10,000, ₹1 lakh, ₹10 lakh, and ₹1 crore. These bonds were valid for 15 days from the date of issuance and can be donated to registered political parties that have secured at least 1% of the votes polled in the last general election to the Lok Sabha or a State Legislative Assembly.

The bonds were issued in the form of promissory notes and did not carry the name of the buyer or the payee political party, ensuring anonymity for the donor. Political parties could encash the bonds within the 15-day validity period through a designated bank account with the authorized bank (State Bank of India).

By channeling donations through the formal banking system and providing donor anonymity, the Electoral Bond Scheme seeked to bring greater transparency and accountability to political funding in India while protecting the privacy of donors.

Supreme Court Struck Down Electoral Bonds Scheme as Unconstitutional

In a landmark unanimous judgment, the Supreme Court of India struck down the electoral bonds scheme as “unconstitutional and manifestly arbitrary”. The court held that the scheme, along with preceding amendments made to key laws, violated voters’ right to information about political funding under Article 19(1)(a) of the Constitution.

The five-judge Constitution bench, headed by Chief Justice DY Chandrachud, outlined several reasons for deeming the electoral bonds scheme unconstitutional:

- Violation of Right to Information: The scheme’s absolute non-disclosure of political donors’ identities violated voters’ fundamental right to know the source of political funding. The court emphasized that information about political funding is essential for voters to make an informed choice.

- Unrestrained Corporate Influence: The scheme, coupled with amendments to the Representation of the People Act, Companies Act, and Income Tax Act, allowed unlimited and anonymous donations by corporations to political parties. This promoted “unrestrained influence of corporates in the electoral process” and threatened the principle of political equality.

- Failure to Curb Black Money: The court rejected the government’s argument that the scheme aimed to curb black money in political funding. It held that the scheme’s complete anonymity provisions did not satisfy the “least restrictive test” necessary for imposing curbs on the right to information.

- Imbalance Between Donor Privacy and Voter Rights: While acknowledging donors’ right to privacy, the court ruled that the scheme failed to strike a balance between protecting donors’ privacy and upholding voters’ right to information.

The Supreme Court directed the State Bank of India to stop issuing electoral bonds immediately and submit details of bonds issued till date, to the Election Commission. The Commission was ordered to publish this information on its official website within a week of receiving it from SBI.

By striking down the electoral bonds scheme, the Supreme Court aimed to restore transparency in political funding and prevent the undue influence of corporate money in the electoral process.

Loopholes in the Electoral Bonds Scheme as per the Judgment

The Supreme Court’s judgment highlighted several loopholes in the electoral bonds scheme that contradicted the government’s claims of ensuring anonymity and curbing black money in political funding:

- Selective Anonymity: The court noted that the scheme provided “selective anonymity” to donors, particularly those who made large contributions. 94% of the contributions were made through electoral bonds in the denomination of one crore rupees, raising doubts about whether such high-value donors would truly want to remain anonymous.

- Gaps Allowing Donor Identification: The court found multiple gaps in the scheme that allowed political parties to identify and personally contact donors. For example, Clause 12 of the scheme stated that electoral bonds could only be encashed by political parties in their designated bank accounts. This allowed contributors to physically hand over bonds to party officials, send them to party offices with their names, or disclose contribution details to party members for cross-verification.

- Information Asymmetry: The principle of anonymity did not apply equally to the government and opposition parties. The ruling party could always access donor details by demanding data from the State Bank of India (SBI), giving it an opportunity to threaten opposition party donors.

- Removal of Donation Limits: The scheme removed the clause in the Companies Act 2013 that limited political contributions to 7.5% of a company’s average net profit in the preceding three financial years. This raised concerns about black money flowing into political funding through shell companies.

- Compromised Shareholder Rights: By allowing companies to “funnel money” to political parties without disclosure, the scheme denied shareholders, who are the owners of the company, the ability to decide how their company should act in the political sphere.

The Supreme Court’s findings exposed the flaws in the government’s arguments that the electoral bonds scheme would ensure donor anonymity and curb black money in political funding. The court’s judgment aimed to restore transparency and prevent the undue influence of corporate money in the electoral process.

Decoding Ulterior Motivations

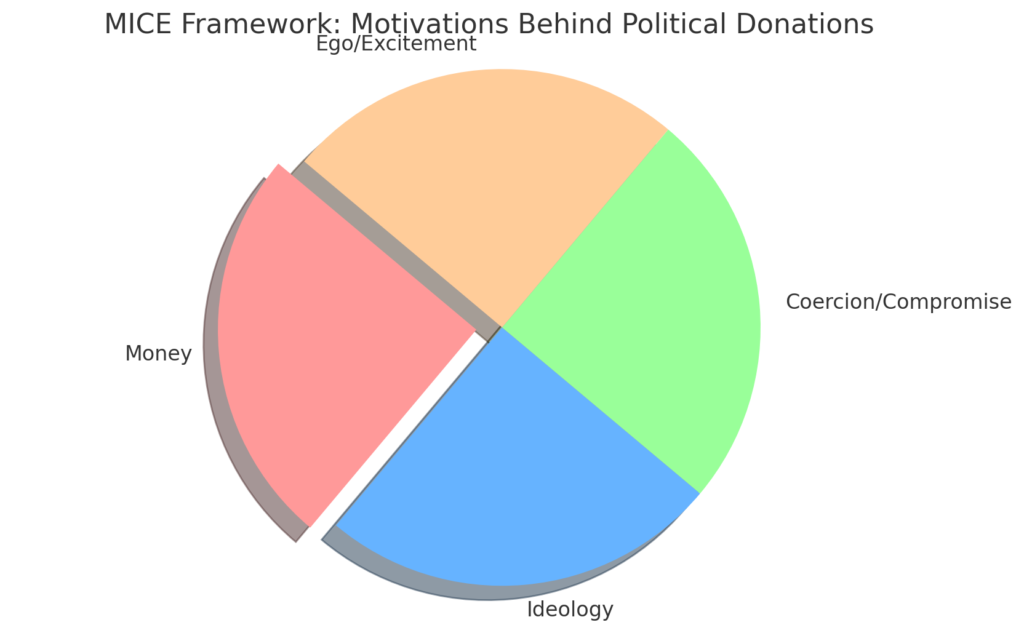

The MICE framework (using only as a decoding reference here and not to be confused in the context of Counter HUMINT) provides a lens to understand the complex motivations behind anonymous political donations. By examining the roles of Money, Ideology, Coercion/Compromise, and Ego/Excitement, we can gain insights into the factors driving donors to contribute through the Electoral Bond Scheme.

Money: Investments Yielding Policy Dividends

For many donors, political contributions serve as strategic investments, with the expectation of influencing policy-making in favor of their business interests. The anonymity provided by Electoral Bonds shields these interests from public scrutiny, allowing donors to shape the political landscape without drawing attention to their involvement.

Investment Motivation Breakdown

| Motivation | Description |

|---|---|

| Policy Influence | Donors seek to shape government policies in ways that benefit their businesses or sectors. For example, a real estate developer may donate to a party that promises to relax land acquisition laws or provide tax incentives for the industry. |

| Regulatory Favors | Contributions may be made with the expectation of receiving favorable regulatory treatment or exemptions. An industrial conglomerate may support a party in hopes of securing environmental clearances or avoiding stricter pollution norms. |

| Access to Contracts | Donors may hope to secure government contracts or projects by supporting the ruling party. Construction companies, for instance, may contribute to the party in power to increase their chances of winning infrastructure development bids. |

Ideology: Supporting Visionary Politics

Ideological alignment is another key motivator for political donations. Donors often seek to support parties that share their vision for the country’s future, contributing to the shaping of national policies and societal progress. The anonymity provided by Electoral Bonds allows donors to back their preferred ideologies without facing public endorsement or backlash.

Ideological Donation Motives

| Visible Support | Anonymous Donation |

|---|---|

| Public endorsement of a party’s ideology, such as vocal support for a party’s stance on secularism or economic liberalization. | Quietly supporting a party’s vision without public association, allowing the donor to maintain a neutral public image while still advancing their ideological beliefs. |

| Openly aligning with a party’s stance on key issues like social welfare or foreign policy. | Contributing to a party’s ideological agenda without drawing attention, especially if the donor’s public stance differs from their private beliefs or if they wish to avoid controversy. |

| Facing potential backlash for supporting controversial positions, such as backing a party with a hardline approach to religious or caste-based issues. | Avoiding public scrutiny while still advancing ideological goals, enabling donors to support causes they believe in without risking their reputation or facing social or economic consequences. |

Coercion/Compromise: The Shadows of Influence

The interplay between political power and business interests can sometimes lead to coerced or compelled donations. In such cases, the anonymity provided by Electoral Bonds serves as a veil of protection against potential repercussions for donors who may feel pressured to contribute.

Coercion in Political Donations

| Type of Coercion | Description |

|---|---|

| Regulatory Pressure | Businesses may face implicit or explicit threats of unfavorable regulatory treatment if they do not contribute. For example, a pharmaceutical company may feel compelled to donate to the ruling party to avoid delays in drug approvals or price control measures. |

| Informal Requests | Political parties may make informal requests for support, with the understanding that non-compliance could have consequences. A media house may receive hints to provide favorable coverage in exchange for financial contributions. |

| Fear of Retribution | Donors may feel compelled to contribute out of fear of retribution or exclusion from government contracts or projects. A technology firm may worry about being sidelined in government digitization initiatives if they do not support the party in power. |

Ego/Excitement: The Personal Dimension of Political Giving

Beyond financial or ideological considerations, the psychological satisfaction derived from influencing political outcomes can be a powerful motivator. The sense of personal ego and the thrill of secretive participation in the political process drive some donors to contribute through the Electoral Bond Scheme.

Psychological Motivations

| Motivation | Description |

|---|---|

| Sense of Influence | Donors may derive satisfaction from the belief that their contributions are shaping political outcomes, even if their role remains hidden from the public eye. The feeling of being a secret kingmaker can be a strong motivator. |

| Participation Thrill | The act of secretly participating in the political process can provide a sense of excitement and importance. The knowledge of being involved in high-stakes political decision-making can be a thrilling experience for some donors. |

| Winning Cause | Contributing to a winning party or candidate can provide a psychological boost and a feeling of being on the “right side.” The satisfaction of backing the winning horse and being part of a successful campaign can be a significant driver for donors. |

Implications and the Path Forward

The interplay of motivations behind political donations raises critical questions about the balance between transparency and anonymity in political funding. While the Electoral Bond Scheme aimed to promote clean money flow and protect donor privacy, it has faced criticism for its potential to enable opaque funding and favor the ruling party.

The Supreme Court’s ruling in March 2024, striking down key provisions of the scheme and ordering the disclosure of donor and recipient details, has brought the issue of transparency to the forefront. As the country grapples with the implications of this ruling, it is crucial to consider the path forward in reconciling the needs for donor privacy with the public interest in transparent political financing.

Enhancing Transparency While Respecting Anonymity

To navigate the challenges of political funding in India, policymakers must seek nuanced approaches that balance transparency and anonymity. Some potential measures could include:

- Lowering the Threshold for Disclosure: By reducing the threshold for disclosing political donations, a greater degree of transparency can be achieved while still protecting the privacy of small donors.

- Strengthening Oversight Mechanisms: Enhancing the role of regulatory bodies, such as the Election Commission of India, in monitoring political funding and ensuring compliance with disclosure requirements can help maintain the integrity of the democratic process.

- Encouraging Grassroots Funding: Promoting small-scale, individual donations can help diversify political funding sources and reduce the influence of large, anonymous contributions.

- Periodic Review and Adjustment: Regularly reviewing and adjusting political funding regulations based on emerging trends and challenges can ensure that the system remains responsive to the evolving needs of democracy.

Conclusion

The Electoral Bond Scheme has brought the complexities of anonymous political funding in India into sharp focus. By applying the MICE framework, we can better understand the multifaceted motivations driving donors to contribute through this scheme, from financial and ideological considerations to the shadows of coercion and the allure of personal ego.

As the country navigates the implications of the Supreme Court’s ruling and seeks to balance transparency and anonymity in political funding, informed dialogue and thoughtful policy interventions will be essential. By fostering a nuanced approach that respects donor privacy while upholding the principles of democratic accountability, India can work towards a political financing system that serves the interests of both donors and the broader public.

In the end, the path forward lies in striking a delicate balance between the need for transparency and the protection of individual rights. By engaging in open and honest discussions about the motivations behind political donations and the role of anonymous funding in our democracy, we can work towards a future where the integrity of our political process is upheld, and the voices of all citizens are heard.