Introduction

The Nifty 50 is a significant benchmark index in India that represents the weighted average of 50 Indian company stocks trading on the National Stock Exchange (NSE). It accounts for 13 sectors and is used extensively to measure the overall performance of the Indian stock market.

Understanding trading strategies and tips for investing in the Nifty 50 is crucial for market participants looking to capitalize on India’s high-growth economy. This article provides a comprehensive guide to investing in the Nifty 50 through various financial instruments while utilizing diverse trading techniques for optimal risk-adjusted returns.

Understanding Nifty 50

The Nifty 50, also known as S&P CNX Nifty or NIFTY 50, is India’s leading equity market index that tracks the behavior of a portfolio of blue-chip companies representing about 66% of its free-float market capitalization.

Launched in 1996 by India Index Services and Products Ltd. (IISL), which is a subsidiary of the National Stock Exchange (NSE), the Nifty 50 is owned and managed by IISL. It captures the pulse of the Indian stock market as the benchmark index.

The Nifty 50 comprises 50 stocks that trade on the National Stock Exchange. The composition of the index is such that it covers 13 sectors of the Indian economy and offers investment managers exposure to the Indian market in one portfolio.

Some prominent companies constituting the Nifty 50 are Reliance Industries Ltd., HDFC Bank Ltd., Infosys Ltd., ICICI Bank Ltd., ITC Ltd., Larsen & Toubro Ltd., and Tata Consultancy Services Ltd., among others.

The Role of Nifty 50 in the Indian Stock Market

- It serves as an underlying asset for exchange-traded funds (ETFs), index funds, and derivatives traded on exchanges in India and globally.

- The Nifty 50 drives sentiments and direction of the overall Indian stock market and economy.

- It acts as a benchmark for fund managers to construct their portfolios and evaluate performance.

- The Nifty 50 represents about 66% of the free-float market capitalization of the stocks listed on NSE as on March 29, 2019.

- It is used extensively by investors in India and globally to take investment decisions.

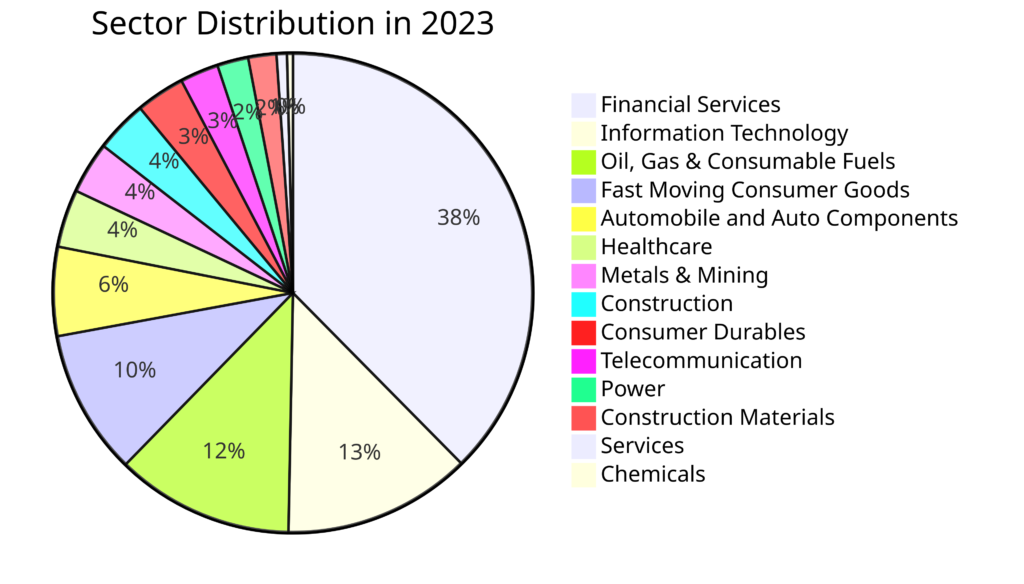

Weightage and representation of sectors across years

| Sector | 2023* | 2022 | 2015 | 2005 | 1995 |

|---|---|---|---|---|---|

| Financial Services | 37.6 | 37.7 | 31.0 | 12.8 | 19.7 |

| Information Technology | 12.7 | 14.0 | 16.3 | 20.0 | – |

| Oil, Gas & Consumable Fuels | 12.0 | 12.7 | 10.6 | 25.0 | 9.8 |

| Fast Moving Consumer Goods | 9.8 | 8.6 | 8.7 | 8.0 | 19.0 |

| Automobile and Auto Components | 6.0 | 5.3 | 9.9 | 6.8 | 12.2 |

| Metals & Mining | 3.5 | 4.2 | 1.3 | 5.5 | 10.9 |

| Healthcare | 3.9 | 3.8 | 7.3 | 4.2 | 2.7 |

| Construction | 3.5 | 3.1 | 3.7 | 1.8 | 4.5 |

| Consumer Durables | 3.3 | 3.1 | 1.4 | – | – |

| Telecommunication | 2.6 | 2.5 | 2.2 | 6.3 | – |

| Power | 2.1 | 1.9 | 2.6 | 1.5 | 2.0 |

| Construction Materials | 1.9 | 1.8 | 2.8 | 2.5 | 5.5 |

| Services | 0.7 | 0.8 | 0.8 | 1.1 | 1.1 |

| Chemicals | 0.4 | 0.5 | – | 0.8 | 7.7 |

| Media, Entertainment & Publication | – | – | 0.8 | 0.5 | – |

| Capital Goods | – | – | 0.5 | 3.1 | 0.6 |

| Textiles | – | – | – | – | 2.2 |

| Consumer Services | – | – | – | – | 1.9 |

Sector Wise representation in 2023-2024

List of Nifty 50 stocks in 2024

| Company Name | Industry | Symbol | Series | ISIN Code |

|---|---|---|---|---|

| Adani Enterprises Ltd. | Metals & Mining | ADANIENT | EQ | INE423A01024 |

| Adani Ports and Special Economic Zone Ltd. | Services | ADANIPORTS | EQ | INE742F01042 |

| Apollo Hospitals Enterprise Ltd. | Healthcare | APOLLOHOSP | EQ | INE437A01024 |

| Asian Paints Ltd. | Consumer Durables | ASIANPAINT | EQ | INE021A01026 |

| Axis Bank Ltd. | Financial Services | AXISBANK | EQ | INE238A01034 |

| Bajaj Auto Ltd. | Automobile and Auto Components | BAJAJ-AUTO | EQ | INE917I01010 |

| Bajaj Finance Ltd. | Financial Services | BAJFINANCE | EQ | INE296A01024 |

| Bajaj Finserv Ltd. | Financial Services | BAJAJFINSV | EQ | INE918I01026 |

| Bharat Petroleum Corporation Ltd. | Oil Gas & Consumable Fuels | BPCL | EQ | INE029A01011 |

| Bharti Airtel Ltd. | Telecommunication | BHARTIARTL | EQ | INE397D01024 |

| Britannia Industries Ltd. | Fast Moving Consumer Goods | BRITANNIA | EQ | INE216A01030 |

| Cipla Ltd. | Healthcare | CIPLA | EQ | INE059A01026 |

| Coal India Ltd. | Oil Gas & Consumable Fuels | COALINDIA | EQ | INE522F01014 |

| Divi’s Laboratories Ltd. | Healthcare | DIVISLAB | EQ | INE361B01024 |

| Dr. Reddy’s Laboratories Ltd. | Healthcare | DRREDDY | EQ | INE089A01023 |

| Eicher Motors Ltd. | Automobile and Auto Components | EICHERMOT | EQ | INE066A01021 |

| Grasim Industries Ltd. | Cement & Cement Products | GRASIM | EQ | INE047A01021 |

| HCL Technologies Ltd. | Information Technology | HCLTECH | EQ | INE860A01027 |

| HDFC Bank Ltd. | Financial Services | HDFCBANK | EQ | INE040A01034 |

| HDFC Life Insurance Company Ltd. | Financial Services | HDFCLIFE | EQ | INE795G01014 |

| Hero MotoCorp Ltd. | Automobile and Auto Components | HEROMOTOCO | EQ | INE158A01026 |

| Hindalco Industries Ltd. | Metals & Mining | HINDALCO | EQ | INE038A01020 |

| Hindustan Unilever Ltd. | Fast Moving Consumer Goods | HINDUNILVR | EQ | INE030A01027 |

| ICICI Bank Ltd. | Financial Services | ICICIBANK | EQ | INE090A01021 |

| ITC Ltd. | Fast Moving Consumer Goods | ITC | EQ | INE154A01025 |

| Indian Oil Corporation Ltd. | Oil Gas & Consumable Fuels | IOC | EQ | INE242A01010 |

| IndusInd Bank Ltd. | Financial Services | INDUSINDBK | EQ | INE095A01012 |

| Infosys Ltd. | Information Technology | INFY | EQ | INE009A01021 |

| JSW Steel Ltd. | Metals & Mining | JSWSTEEL | EQ | INE019A01038 |

| Kotak Mahindra Bank Ltd. | Financial Services | KOTAKBANK | EQ | INE237A01028 |

| Larsen & Toubro Ltd. | Construction & Engineering | LT | EQ | INE018A01030 |

| Mahindra & Mahindra Ltd. | Automobile and Auto Components | M&M | EQ | INE101A01026 |

| Maruti Suzuki India Ltd. | Automobile and Auto Components | MARUTI | EQ | INE585B01010 |

| NTPC Ltd. | Power | NTPC | EQ | INE733E01010 |

| Nestle India Ltd. | Fast Moving Consumer Goods | NESTLEIND | EQ | INE239A01024 |

| Oil & Natural Gas Corporation Ltd. | Oil Gas & Consumable Fuels | ONGC | EQ | INE213A01029 |

| Power Grid Corporation of India Ltd. | Power | POWERGRID | EQ | INE752E01010 |

| Reliance Industries Ltd. | Oil Gas & Consumable Fuels | RELIANCE | EQ | INE002A01018 |

| SBI Life Insurance Company Ltd. | Financial Services | SBILIFE | EQ | INE123W01016 |

| State Bank of India | Financial Services | SBIN | EQ | INE062A01020 |

| Sun Pharmaceutical Industries Ltd. | Healthcare | SUNPHARMA | EQ | INE044A01036 |

| Tata Consultancy Services Ltd. | Information Technology | TCS | EQ | INE467B01029 |

| Tata Consumer Products Ltd. | Fast Moving Consumer Goods | TATACONSUM | EQ | INE192A01025 |

| Tata Motors Ltd. | Automobile and Auto Components | TATAMOTORS | EQ | INE155A01022 |

| Tata Steel Ltd. | Metals & Mining | TATASTEEL | EQ | INE081A01020 |

| Tech Mahindra Ltd. | Information Technology | TECHM | EQ | INE669C01036 |

| Titan Company Ltd. | Consumer Durables | TITAN | EQ | INE280A01028 |

| UPL Ltd. | Chemicals | UPL | EQ | INE628A01036 |

| UltraTech Cement Ltd. | Construction Materials | ULTRACEMCO | EQ | INE481G01011 |

| Wipro Ltd. | Information Technology | WIPRO | EQ | INE075A01022 |

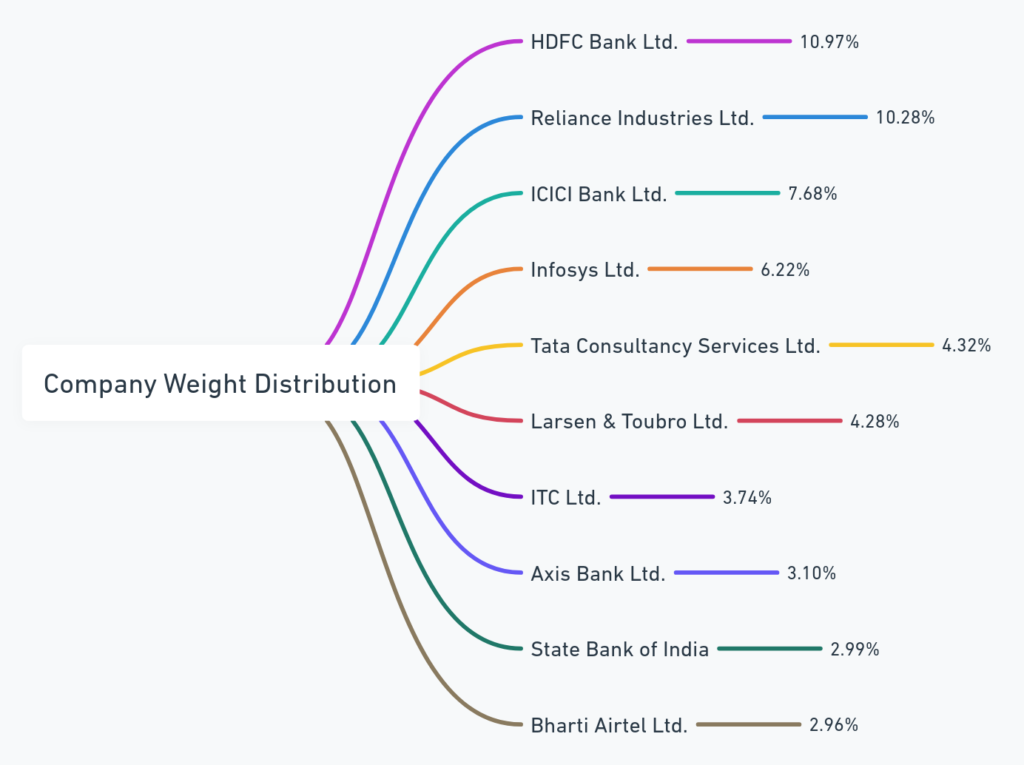

Top 10 constituents of Nifty 50 by weightage

| Company’s Name | Weight(%) |

|---|---|

| HDFC Bank Ltd. | 10.97 |

| Reliance Industries Ltd. | 10.28 |

| ICICI Bank Ltd. | 7.68 |

| Infosys Ltd. | 6.22 |

| Tata Consultancy Services Ltd. | 4.32 |

| Larsen & Toubro Ltd. | 4.28 |

| ITC Ltd. | 3.74 |

| Axis Bank Ltd. | 3.10 |

| State Bank of India | 2.99 |

| Bharti Airtel Ltd. | 2.96 |

Indian Blue Chips: Index Heavyweights and Their Influence

The Indian stock market benchmark index, Nifty 50, represents the performance of the 50 largest Indian companies by market capitalization. The index composition and the weightage of each constituent stock play a crucial role in determining overall returns. As the Nifty 50 is market-cap weighted, the top 10 stocks account for over 60% of the index. Let’s examine the top 10 index heavyweights and their sway.

HDFC Bank Takes Pole Position

HDFC Bank Ltd. is the largest stock in the Nifty 50 with an index weightage of 10.97%. As a leading private sector bank in India catering to over 60 million customers, HDFC Bank has delivered a strong track record of financial performance and shareholder returns over the past decade. Its recent merger with housing finance company HDFC Ltd. has further bolstered its market dominance.

Mukesh Ambani’s Cash Cow Retains #2 Spot

Reliance Industries Ltd. (RIL), owned by India’s richest man Mukesh Ambani, holds the second spot with a 10.28% weightage. RIL’s diversified business interests spanning oil and gas, petrochemicals, telecom, and retail make it a force to reckon with. The company has also made big bets on new energy and digital services which could emerge as future growth engines.

ICICI Bank Ranks Third

ICICI Bank, India’s second-largest private sector bank, has an index weight of 7.68%. The lender has undertaken several initiatives in digital banking and partnerships across ecosystems to ramp up retail and MSME lending. Along with HDFC Bank, ICICI Bank remains a key proxy for rising consumer demand in India.

The other prominent names in the top 10 list include IT majors Infosys and TCS, engineering conglomerate L&T, cigarette maker ITC, private lender Axis Bank, telecom giant Airtel and state-owned banking behemoth SBI.

Outsized Influence on Index Returns

The top 3 stocks – HDFC Bank, Reliance and ICICI Bank – together influence nearly 30% of the Nifty 50’s movement. On average, these stocks individually contribute over 0.5% daily change in the index. When accorded higher weights in periodic reviews, they tend to buoy overall returns. Their earnings performance also has a bearing on investor sentiment across sectors.

In a nutshell, the index heavyweights represent the crown jewels of corporate India. Their financial health and stock price trajectory is closely tracked by market participants as a barometer of the economy’s direction.

Why Invest in Nifty?

Here are some of the important reasons why investors should consider including Nifty 50 in their investment portfolios:

Diversification Benefits

The Nifty 50, representing 13 major sectors of the Indian economy, offers diversification when included in a portfolio. Investing in the Nifty 50 index leads to risk reduction due to diversification across sectors and stocks.

The Nifty 50 has offered decent returns over the long term, making a case for investments for the long run. As per historical data, the Nifty 50 has delivered a CAGR return of about 12% in the last 10 years.

Low Costs

Investing through Nifty index funds and ETFs provides market exposure at very low costs. They carry significantly lower expense ratios compared to actively managed mutual funds.

Transparency

The Nifty 50 has a transparent way of functioning. IISL discloses information on index maintenance, review policies, and inclusion criteria of stocks in the index publicly.

Comparing Long-Term Investment vs. Short-Term Trading Strategies

Investors can utilize the Nifty 50 differently based on their horizon, goals, and risk appetite:

- Long-term investors can invest in the Nifty 50 through index funds and ETFs to create wealth over long periods. Historically, the Nifty 50 has rewarded long-term investors handsomely.

- Short-term traders can use the Nifty 50 derivatives like futures and options contracts to capitalize on short-term trends and volatility in the markets. Traders employ technical analysis and charting to time their trades using Nifty contracts.

Investment Options in Nifty

There are various ways for investors to gain exposure to the Nifty 50 index based on their investment objectives and risk tolerance:

Investing Through Mutual Funds

Mutual funds allow investors to participate in the index while avoiding the complexities of directly investing in the stock market.

Advantages of Investing in Nifty Index Funds

Some benefits of investing in Nifty index funds are:

- Diversification: Single investment leading to exposure across 50 large-cap stocks.

- Low Cost: Significantly lower expense ratios compared to actively managed mutual funds.

- Long-Term Growth: Historically rewarded investors over long investment horizons.

- Transparent: Portfolio disclosure requirements and regulation by SEBI.

- Easy to Invest: Convenient online and offline modes. SIPs allow systematic investing.

- Tax Efficient: Long term capital gains tax and equity-linked tax savings.

As per historical data, the Nifty 50 has delivered a CAGR return of about 12% in the last 10 years. Hence, they are meant to be held for long periods as part of one’s core portfolio.

How Index Funds Provide Broad Market Exposure

An index fund like Nifty 50 comprises the same stocks in the same proportion as the underlying index it tracks. For example, an index fund tracking Nifty 50 will invest about 9% of its corpus in RIL and 8% in HDFC Bank as per their index weightage. This ensures diversification and broad market exposure at low costs.

Some popular Nifty index funds are:

- UTI Nifty Index Fund

- HDFC Index Fund – Nifty 50 Plan

- ICICI Prudential Nifty Index Fund

- Aditya Birla Sun Life Index Fund

- Nippon India Index Fund – Nifty Plan

These funds provide exposure to the Nifty 50 index by investing in securities of the benchmark index in similar weightage and composition.

Cost-Effectiveness of Index Funds

Index funds offer significant cost benefits over actively managed mutual funds. Since index funds are passively managed and do not require extensive research, their expense ratios are very low.

Nifty index funds have expense ratios in the range of 0.1% to 0.25% compared to over 2% for actively managed equity funds on average. Lower costs translate into higher returns in the hands of investors over long periods due to the power of compounding.

Trading Nifty Derivatives

Nifty derivatives like futures and options contracts allow traders to speculate on the short-term direction of the Nifty 50. Traders employ technical analysis and complex strategies using these instruments.

Overview of Futures and Options as Trading Tools

Nifty futures contracts are binding agreements to buy or sell the Nifty 50 index on a future fixed date at a specified price. Traders use futures to speculate on the short-term trend of the Nifty 50.

Nifty options give buyers the right but not the obligation to buy/sell the index at the agreed strike price on expiry. Call options gain value if Nifty moves above the strike price while put options gain value when the Nifty drops below.

Traders combine options in creative ways to define risk through volatility-based strategies like spreads, straddles, strangles, butterflies, and condors.

Strategies for Trading Nifty Through Derivatives Contracts

Here are some popular trading strategies using Nifty derivatives:

- Trend Trading: Ride strong uptrends/downtrends using futures and options.

- Range Trading: Profit from sideways moves using options.

- Hedging: Hedge existing portfolio from market crashes using index puts.

- Arbitrage: Exploit pricing inefficiencies using futures and options.

- Speculation: Bet on expected market moves through buying options.

Traders use technical indicators, chart patterns, quantitative models, and algorithms to time the markets while trading derivatives.

Trading Strategies for Nifty

Here are some tactical ways traders can trade the Nifty 50 in the short term:

Technical Analysis and Charting

Traders employ technical analysis techniques like indicators, oscillators, and chart patterns to identify trading opportunities in Nifty 50.

Utilizing Candlestick Charts

Candlestick charts are extensively used to visualize price patterns and trends in intraday Nifty trading. Here are some basic single/multi-candlestick patterns and associated strategies traders use:

| Candlestick Pattern | Trading Strategy |

|---|---|

| Long green candle | Indicates bullishness. Look for long trades |

| Long red candle | Indicates bearishness. Look for short trades |

| Doji | Indicates indecision. Avoid trades |

| Hammer, inverted hammer | Potential reversal signals |

| Engulfing patterns | Strong reversal signals |

| Morning and evening stars | Likely trend reversals |

These patterns assume significance based on volume and other indicator confirmations. Traders combine candlestick and Western technical techniques for trade signals.

Gap Trading Strategies

Gaps represent empty spaces between candlestick or bar charts and signal potential for major market moves.

Gap up: Bullish signal indicating strong buying interest. Traders look to buy and ride the uptrend.

Gap down: Bearish signal indicating panic selling. Traders look to short sell and profit from subsequent downtrend.

Since gaps represent inefficiency in markets, prices tend to return to fill gaps as per technical analysis principles. Traders prepare for trend reversals when gaps get filled.

Risk Management in Nifty Trading

Managing risk effectively is crucial while trading a volatile index like Nifty 50. Some risk management techniques are:

Importance of Regular Monitoring and Adjustment

Traders must monitor open positions in Nifty closely and dynamically adjust stop-losses to account for changing market conditions. Stop-losses prevent potentially unlimited losses when the view goes wrong.

Strategies for Managing Risks

Here are some strategies traders employ to curb losses:

- Selling covered calls: Holding long futures position while selling higher strike call options to earn premium income.

- Cash-secured puts: Shorting Nifty futures while buying lower strike put options for downside protection.

- Bracket orders: Place orders to book profits at pre-defined levels while also having stop-losses in place for adverse moves.

- Portfolio diversification: Balance Nifty positions with other uncorrelated assets to manage overall risk exposure.

Advanced Trading Strategies

Let us consider some advanced techniques used by professional traders:

Bank Nifty Options Trading

Bank Nifty is an index representing 12 major banking stocks trading on NSE. It serves as a banking sector benchmark.

Specific Strategies for Trading Bank Nifty Options

- Iron Condor: Sell out of the money call and put options at two strike prices while buying further OTM calls and puts to profit from range-bound non-directional moves.

- Ratio Call Spread: Buying ITM call options while selling multiple higher strike OTM calls to reduce premium outflows.

- Put Ratio Spread: Sell lower strike put options while buying greater number of higher strike puts to profit from market stability or uptrends.

Utilizing 5-Minute Candlestick Charts

Intraday traders use short duration charts like 5-minute candles to identify trading opportunities with extremely short holding periods. Strategies include:

- Scalping: Placing multiple small profitable trades during a day while avoiding overnight risk.

- News-based trading: Rapid entries and exits around major news events and data releases.

- High-frequency algo trading: Computerized models placing large orders within milliseconds based on quantitative triggers.

Common Mistakes to Avoid

Here are some tactical errors Nifty traders must avoid:

Overleveraging

Using excess leverage while trading Nifty may lead to amplified losses exceeding one’s capital. Avoid trading without proper risk management.

Not Setting Stop Losses

Not placing stop-loss orders can turn a small loss into a catastrophe if the market moves sharply against. Stop-losses enforce discipline.

Ignoring Market Trends

Trying to trade against the prevailing trend usually leads novice traders to lose money while experienced traders wait patiently.

Not Tracking Economic Indicators

Macroeconomic data, corporate earnings results, global cues set trends. Not tracking these leads to trading in isolation.

Conclusion

The Nifty 50 is a key benchmark that represents the performance of the overall Indian stock markets. Investors have multiple options like index funds and ETFs to participate in the India growth story over the long run at low costs.

On the other hand, the Nifty 50 and its sectoral indices like Bank Nifty serve as underlying assets for derivatives trading allowing speculation by experienced traders using advanced techniques.

Having a trading edge requires continuously learning, adapting strategies aligned with evolving market dynamics, practicing solid risk management, and keeping emotions aside.