Key Takeaways from FOMC Minutes

| Key Takeaway | Details |

|---|---|

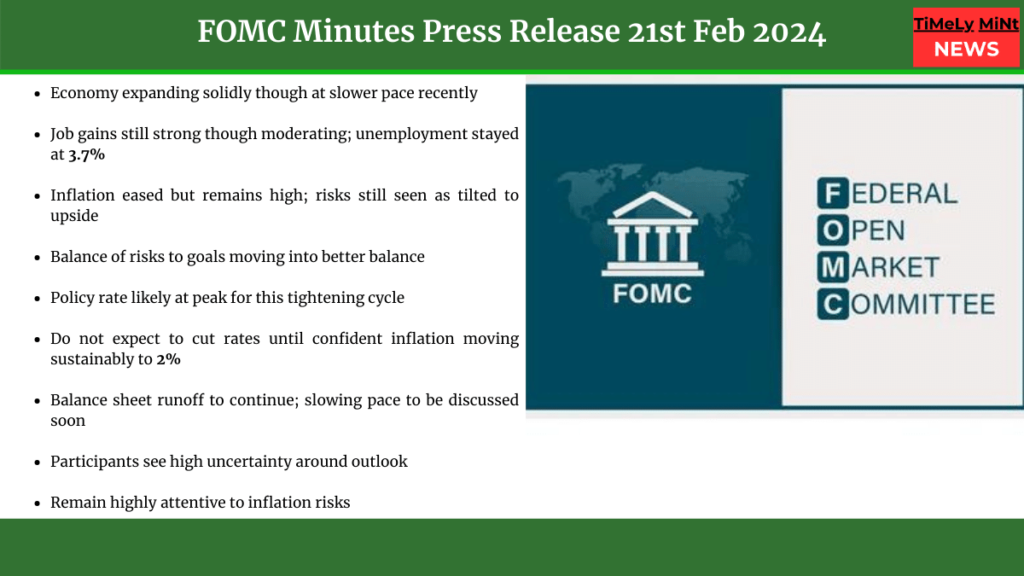

| Economy expanding solidly, though at slower pace | GDP growth solid in Q4 2023 but below Q3’s strong pace. Consumption driving growth, while net exports and inventories contributed significantly. |

| Job gains still strong but moderating | Payroll growth slower than early 2022 but still robust. Unemployment rate steady at 3.7% in December. Further signs of easing labor market tightness. |

| Inflation eased but remains high | Inflation declined over past year but still above 2% target. Risks still seen as tilted to upside. Progress made but some improvement reflects temporary factors. |

| Risks to goals moving toward balance | Progress on inflation and continued labor market improvements cited. But risks still tilted to upside on inflation. |

| Policy rate likely at peak | Given demand-supply rebalancing and inflation decline so far. But rate cuts not expected until confident inflation will reach 2% sustainably. |

| Balance sheet reduction to continue | Will discuss slowing pace soon given declining ON RRP usage. Could smooth transition to ample reserves. |

Economy Solid Though Moderating; Inflation Still Elevated

The FOMC minutes from the January 30-31 meeting showed participants viewed economic activity as expanding at a solid pace, though growth has moderated from mid-2022.

Real GDP expanded at 3% annual rate in Q4 2023. While below Q3’s strong pace, it exceeded expectations. Consumption continued driving growth, while net exports and inventories contributed significantly.

Job gains have slowed since early 2022 but remain robust. The unemployment rate held at 3.7% in December. Participants saw further signs of easing labor market tightness.

Inflation Eases But Remains High

Inflation has eased over the past year but remains elevated compared to the Fed’s 2% target. Participants noted improvements in headline and core inflation but said risks still tilted to the upside.

Key reasons cited for moderation:

- Annualized core PCE near 2% recently

- Slowing wage growth

- Anchored longer-term inflation expectations

- Firms having more difficulty passing on costs

Balance of Risks Improving

Participants viewed risks to achieving employment and inflation goals as moving into better balance given progress on inflation and labor market alignment.

However, they do not expect to reduce rates until confident inflation will reach 2% sustainably. The path of rates will depend on incoming data and risks around the outlook.

Policy Rate Likely at Peak

Participants saw the policy rate as likely at its peak for this tightening cycle given the demand-supply rebalancing and inflation decline so far.

However, they emphasized not expecting to cut rates until inflation moves sustainably to target.

Balance Sheet Reduction to Continue

FOMC will press ahead with balance sheet runoff for now but will discuss slowing the pace soon given declining ON RRP usage.

Runoff could continue even after rate cuts start.

FAQs

What were the key reasons cited for the moderation in inflation?

Participants noted improvements in both headline and core inflation measures, but judged some of the improvement reflects idiosyncratic factors. Contributing reasons cited include annualized core PCE near 2% recently, slowing wage growth, anchored longer-term inflation expectations, and firms having more difficulty passing on costs.

How long do participants expect to maintain the current federal funds rate target range?

Participants viewed the policy rate as likely at its peak for this tightening cycle. However, they do not expect to reduce rates until confident inflation is moving sustainably to the 2% target. The path will depend on incoming data and risks around the outlook.

What factors suggest risks to goals are moving into better balance?

Progress on inflation declining toward target and continued improvements in alignment of demand and supply in product and labor markets were cited as reasons risks are moving into better balance. However, risks still seen as tilted to the upside on inflation.

When and why might the Committee slow the pace of balance sheet runoff?

Many participants suggested discussing slowing runoff soon given declining usage of the ON RRP facility. This could smooth the transition to an ample reserves level or allow runoff to continue longer. Runoff may continue even after rate cuts start.