Introduction

The Initial Public Offering (IPO) landscape in India has seen tremendous growth over the past decade. An increasing number of companies are tapping into the Indian stock market to raise capital and expand their operations. For investors, IPOs present lucrative opportunities to get in early on rising organizations. However, navigating the complex IPO process requires in-depth research and understanding of the governing SEBI regulations.

IPOs play a crucial role for both companies and investors. For companies, they allow raising capital for growth, debt repayment, enhanced visibility and meeting promoter shareholding norms mandated by SEBI. For investors, IPOs present an early opportunity to invest in a company at the ground level and gain from future growth.

This comprehensive guide takes you through all key aspects of investing in IPOs – from understanding the process, importance of research, and risk-return trade-offs to step-by-step instructions on applying for shares.

Key Takeaways

- IPOs allow companies to raise capital for growth while offering investors early access to rising organizations.

- India’s IPO market has seen tremendous growth, with 2021 witnessing record fundraising of over $18 billion across 63 IPOs.

- Thorough research across business model, financials, valuations, management credibility, and risk factors is crucial before investing in IPOs.

- Understanding the IPO process involving drafting of prospectus, securing regulatory approvals, marketing roadshows, bidding, allotment and listing is important.

- Retail investors should focus on long-term fundamentals rather than short-term listing gains alone while assessing IPOs.

Understanding IPOs

An Initial Public Offering (IPO) refers to the first time sale of shares by a private company to the public through the stock exchanges. It marks the company’s transformation from being privately held to becoming publicly traded.

Definition and Basics

- An IPO allows a company to tap into public capital markets to raise funds for business expansion, debt repayment, enhanced visibility, and meeting regulatory shareholding requirements.

- In an IPO, the company offers its shares to institutional and retail investors at a pre-decided price band. The IPO pricing is determined through book building and fixed price offering methods.

- Upon successful listing, the company gets listed on stock exchanges where its shares can be publicly subscribed to and traded.

Key Differences from Other Investment Options

IPOs differ from other market-linked investments on several aspects:

| Parameter | IPO | Secondary Market Stocks |

| Stage of company | Early stage | Mature stage |

| Financial data | Limited data | Extensive historical data |

| Valuations | Based on projections | Based on financial performance |

| Volatility | High volatility expected | Relatively stable |

| Regulations | Stringent check | Light touch regulations |

The IPO Process in India

In India, the IPO process is governed by strict guidelines laid out by market regulator Securities and Exchange Board of India (SEBI). Here are the key steps:

Overview of Regulatory Framework

- SEBI regulations cover all key aspects – appointment of merchant bankers, drafting prospectus, marketing, pricing strategies, allotment methodology, listing, etc.

- Key regulations include SEBI ICDR guidelines, LODR regulations, and SAST / Takeover code. Regular amendments ensure investor protection.

Step-by-Step IPO Process

The typical process flow for an IPO is depicted below:

IPO Process Flowchart

Let’s understand each step in detail:

1. Appointing an Investment Bank

- The company appoints one or more investment banks to advise on regulatory processes, valuation, drafting offer documents, marketing the IPO, underwriting support and end-to-end issue management.

2. SEBI Registration

- The company files for IPO through merchant bankers across 2 filings – Draft Red Herring Prospectus (DRHP) and Final RHP detailing business model, financials, use of funds, risks, etc.

- SEBI reviews filings to ensure compliance with ICDR regulations and provides observations.

3. Stock Exchange Application

- The company applies for listing permission from stock exchanges – BSE and NSE.

- Exchanges review compliance readiness on listing requirements.

4. Marketing and Roadshows

- Company management conducts investor roadshows domestically and internationally to market the IPO.

- One-on-one meetings are held with institutional investors to gauge demand.

5. Pricing and Allocation

- Company and bankers decide price band based on regulatory formulas and investor demand.

- SEBI approves price band and share allocation to investors is finalized through lottery system.

6. Trading and Post Issue Compliance

- Upon closure, shares are listed and trading commences. Various post-IPO compliance requirements around financial reporting, disclosure and governance kick in.

Key Considerations Before Investing in an IPO

Investing in IPOs can be rewarding but requires researching multiple aspects of the issue and company:

Researching the Company

Analyze business model, financial health, growth levers, peer comparison, promoter background to determine investment merit:

- Business Sector Analysis: Assess market size, growth trends, competitive landscape, margin analysis

- Management Track Record: Review background and success of promoters and senior leadership

- Financial Analysis: Scrutinize P&L statements, balance sheet, cash flows; auditor credentials

- Valuations Benchmarking: Compare with listed industry peers on valuation multiples like P/E, P/B ratios

Market Trends and Timing

Time the investment decision based on:

- IPO market conditions: Analyze recent listing performance, oversubscription trends

- Industry trends: Favourable industry outlook provides tailwinds to stock price

- Market trends: Broader market sentiment impacts investor risk appetite

Reading the Prospectus

The Red Herring Prospectus (RHP) offers deep dive into the company. Key aspects to consider:

- Business Background: Evolution, milestones, partnerships

- Financial Statements: P&L, balance sheets, cash flow statements

- Risk Factors: Investigate red flags around operations, compliance, valuations

- Use of Funds: Analyze deployment areas – new projects, debt payment, inorganic growth

Understanding the Risks

Key risks involved in IPO investing:

- Volatility Risk: Price swings for newly listed stocks due to variable demand-supply

- Compliance Risk: Meeting stringent post-listing compliance requirements

- Investor Relations Risks: Managing minority investor expectations on returns

Thorough research is key to balance return potential with risks involved.

How to Invest in an IPO

Here is a step-by-step guide to subscribing for IPO shares:

Eligibility and Requirements

To invest in IPOs, you must have:

- Demat account: To get allotted electronic shares and trade post-listing

- PAN card: PAN details required in application form

- Bank account: For refunds in case of non-allotment

Additionally, ensure account has sufficient funds for applying.

The Application Process

You can apply for IPO shares through:

- Online using net banking: Easy, instant process through integrated platforms

- Physical application form: Fill and submit form along with cheque to intermediaries

The application process typically opens 3-4 days before the close date.

Pricing Strategies

IPOs are offered through:

- Fixed price method: Price pre-decided based on book built demand. Retail investors can apply for minimum lot size.

- Book building method: Price range given. Investors bid within range. Cut-off price fixed later.

Allotment and Listing

Share allocation is done through lottery system. Basis allotment:

- Shares credited to Demat account

- Trading starts on listing date per stock exchange rules

- Financial performance tracked as part of post-IPO compliance

Case Studies and Expert Opinions

Let’s analyze a few IPO case studies to understand what makes a successful public issue:

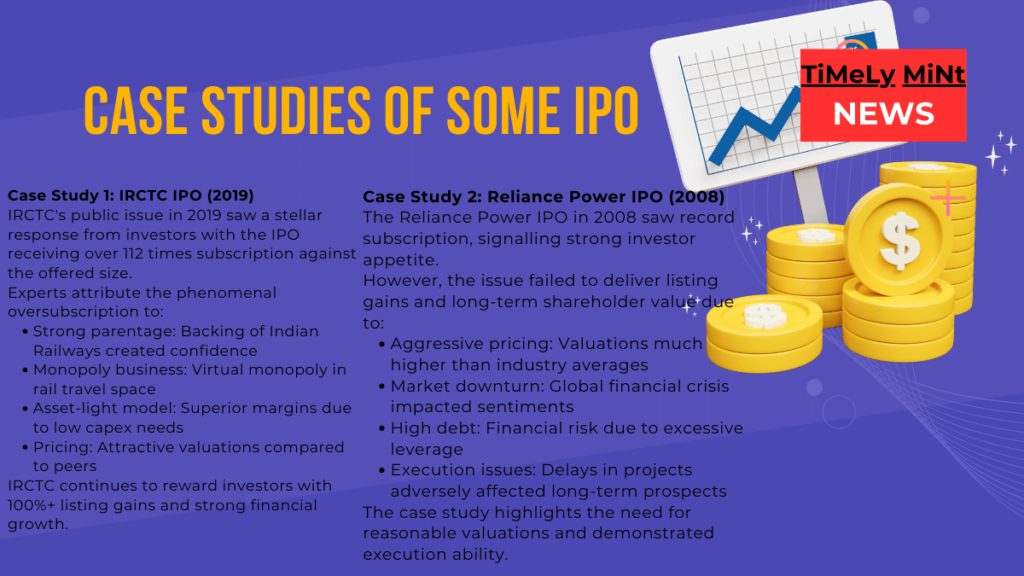

Case Study 1: IRCTC IPO (2019)

IRCTC‘s public issue in 2019 saw a stellar response from investors with the IPO receiving over 112 times subscription against the offered size.

Experts attribute the phenomenal oversubscription to:

- Strong parentage: Backing of Indian Railways created confidence

- Monopoly business: Virtual monopoly in rail travel space

- Asset-light model: Superior margins due to low capex needs

- Pricing: Attractive valuations compared to peers

IRCTC continues to reward investors with 100%+ listing gains and strong financial growth.

Case Study 2: Reliance Power IPO (2008)

The Reliance Power IPO in 2008 saw record subscription, signalling strong investor appetite.

However, the issue failed to deliver listing gains and long-term shareholder value due to:

- Aggressive pricing: Valuations much higher than industry averages

- Market downturn: Global financial crisis impacted sentiments

- High debt: Financial risk due to excessive leverage

- Execution issues: Delays in projects adversely affected long-term prospects

The case study highlights the need for reasonable valuations and demonstrated execution ability.

As per veteran investor Warren Buffett: “Price is what you pay. Value is what you get.” Proper valuation analysis is key to IPO investing success.

Pros and Cons

Advantages of Investing in IPOs

Let’s examine the benefits associated with IPO investments:

- Wealth Creation Opportunity: Chance to gain from future growth by investing early

- Liquidity: Public listing provides exit options through sale on exchange

- Diversification: IPOs increase overall market depth and expand options

- Profitability: Many IPOs have given high double-digit to triple-digit returns

However, there are risks involved too which need to be accounted for.

Disadvantages of Investing in IPOs

Key downsides to evaluate before investing in IPOs:

- Volatility: Newly listed stocks see high price fluctuations

- Information Asymmetry: Limited historical data available

- Regulatory Oversight: Stringent compliance and governance requirements

- Pricing Pressures: Overpriced issues often underperform in long run

Thus, while IPOs carry significant wealth creation potential, the risks call for thorough research and prudent judgement before investing hard earned savings.

Conclusion

IPOs play an invaluable role in capital formation and value creation in financial markets. For companies, they open up access to public capital while investors can gain from future growth prospects.

However, lack of historical data and complex regulations make analyzing IPOs challenging. This guide aims to bridge this gap by offering a step-by-step walkthrough of the IPO process while highlighting key pointers for investing success.

With the right understanding and analytical approach, retail investors can tap into the wealth creation prospects offered by IPOs. The guide should help you kickstart your IPO investment journey!

FAQs on Investing in IPOs

1. What is an IPO?

An IPO or Initial Public Offering refers to the first-time sale of shares by a private company to public investors through the stock exchanges.

2. How can I apply for an IPO?

You can apply for IPO shares online using your demat account or through physical IPO application forms. Ensure you have a valid PAN card and sufficient funds.

3. What details are covered in an IPO prospectus?

The offer document covers background, financials, business model, risk factors, objects of the issue, management details to help you analyze the IPO.

4. What is the difference between fixed price and book building IPOs?

In fixed price, the share price is pre-decided by the company. In book-building, investors bid within a price band and the final price is set based on demand.

5. How does the IPO allotment process work?

IPO allotment is done through a lottery system for retail investors. Allotted shares are credited to your demat account before listing.

6. When does an IPO get listed on the exchanges?

The listing date is mentioned in the offer document. Trading on exchanges commences from the day of listing as per stock exchange rules.

7. What financial ratios should I check before applying to an IPO?

Analyze key ratios like P/E, P/B, debt-equity ratio, RoNW, RoCE, EPS, NAV etc. and compare with industry peers.

8. What happens if an IPO gets oversubscribed by a large margin?

In case of high oversubscription, the allotment ratio falls leading to very few applicants getting share allotment.

9. How do I track upcoming IPOs in India?

Upcoming IPOs are covered extensively in financial newspapers and websites. You can also refer to BSE and NSE websites for latest IPO announcements.

10. Is there a lock-in period for IPO shares?

Yes, IPO shares held by promoters have a lock-in of 1-3 years. For investors, there are no post-listing lock-ins.

11. Can I withdraw my IPO application once submitted?

No. IPO applications cannot be revised or withdrawn by investors once submitted to collecting banks/brokers.

12. Does applying for IPOs require a demat account?

Yes, having a demat account is mandatory to apply for shares in an IPO and hold them post allotment.

13. How do I determine if an IPO is overpriced or under-priced?

Compare IPO valuations like P/E, P/B ratios with listed industry peers to assess if issue is overpriced or attractively priced.

14. What is the minimum investment size for retail investors in IPOs?

The minimum application size differs across IPOs but is generally in the range of ₹12,000-₹15,000 per retail investor lot.

15. Where can I easily find details on upcoming IPOs in India?

Leading financial websites provide latest IPO news, schedule, analysis & reviews. BSE, NSE sites share official IPO announcements.